2018 Profit And Loss Form

- Fillable Profit And Loss Statement

- 2018 Profit And Loss Schedule C Form

- Free Profit And Loss Template Self Employed

31 Net profit or (loss). Subtract line 30 from line 29. If a profit, enter on both. Schedule 1 (Form 1040), line 12 (or. Form 1040NR, line 13) and on. Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on. Form 1041, line 3. If a loss, you. Go to line 32. 31. Proit and Loss Statement All borrowers who are self-employed or independent contractors should complete this form if they do not already have their own proit and loss statement. Company Name: Company Address: Type of Business: Borrower Name(s): Loan Number: Dates Reported on this Form.

Hydril pulsation dampener manual. The Hydril K-P Series Pulsation Dampener/Surge Stabilizer should be mounted in the vertical position (refer to Figure 1- 3 and 1-4 for mounting options) with the mating flange con- nection at the bottom. The discharge dampener should be mounted as close as possible to the discharge port of the pump. KEY FEATURES Hydril IP pulsation dampeners extend the life and increase the efficiency of suction, discharge and hydraulic flow system lines. Built for industrial and production applications, the non-wetted shell design reduces maintenance require- ments while accommodating corrosive process liquids. Manufactured to meet the most demanding large-volume, high-slurry pump applications, Hydril K pulsation dampeners offer outstanding performance for onshore and offshore drilling, airport fueling systems, tank truck and marine loading racks, fire water systems, sewage lines and other large scale pulsation and surge control applications. Installation and Operation Manual Chargeable Dampener Models Dampeners are pressure vessels containing a flexible bladder or bellows inside that separates an inert pressurized gas (air or Nitrogen) from a system fluid in the lower chamber. Depending on how dampeners are configured, they are used as Pulsation Dampeners, Inlet Stabilizers.

A Profit and Loss Statement Form or Income Statement is a component of Business Financial Statement Forms that outlines the total revenue and total expenses of a company over a given period of time, usually a fiscal year. From its name itself, it helps a company identify if there were any profit or loss during the given period. This way, the company can assess their profitability or their ability to generate income.

Related:

Sample Profit and Loss Statement Form

Example Monthly Profit & Loss Statement Form

Profit and Loss Statement for Homeowners

Free Profit and Loss For Human Services

Parts of a Profit and Loss Statement Form

- Gross Profit: This is calculated by subtracting the cost of goods sold from the net sales. The net sales includes the revenue from products and / or services sold after the deduction of returns, allowances, discounts, and damaged or missing items. The cost of goods sold comprises the cost of direct labor and materials, any overhead expenses that went into manufacturing the products.

- Operating Income: This is calculated by subtracting the operating expenses from the calculated gross profit. Operating expenses are those that go toward administration costs, like the wages of employees that do not directly have anything to do with manufacturing the product. Other expenses included in this bracket are utilities, marketing, insurance, transportation, and depreciation of assets among others. The resulting value, which is the operating income, is the total income of a company from its normal business functions.

- Non-operating Income: This is the deduction of non-operating expenses from non-operating revenues. These are expenses and revenues that do not have anything to do with the normal functions of the business. Common examples are interest from the sale of investments, and losses from lawsuits and interest paid to lenders.

- Net Income: This is the leftover income after all expenses have been deducted. If it is positive, then there is a profit. If it is negative, then there is loss. The net income is then added to the retained earnings of a company, which can be used to invest in business activities. You may also our other Statement Forms like our Witness Statement Form and Statement of Information Form.

Business Profit and Loss Statement Form in Excel

Fundraiser Profit and Loss Statement Form

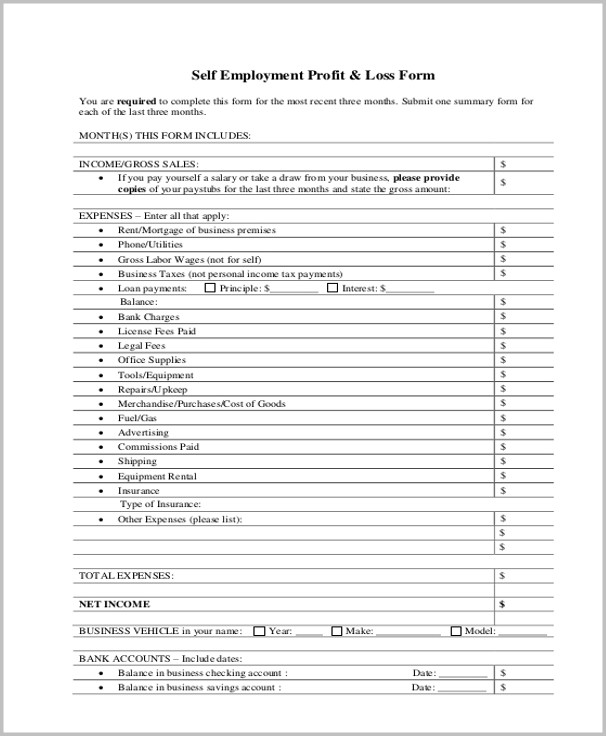

Self Employment Profit and Loss Statement Form

Fillable Profit And Loss Statement

Schedule C Profit and Loss Statement Form Format

2018 Profit And Loss Schedule C Form

Calculating the net income of your company over a given period of time can allow you to see if you’ve made any profit. This information, along with a cash flow statement, can help you identify areas of improvement for budget cuts to increase your income and decrease expenses. This can be done quarterly and annually for close monitoring, because as a company grows, the revenues grow as well, but the expenses could also be growing at a faster rate. You may also see our Sample Financial Statement Forms for other parts of a Business Financial Statement. This can help you have a more integrated outline of your company’s financial standing.